Size : $2.99 (abo Mb

Version: 2.7

Req: 1.6 and up

Latest update: 10.02.2020

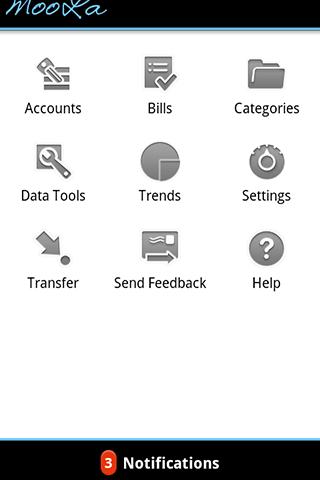

Deskripsi mooLa! Platinum Edition

Easily track your finances, all in one place in this smart, sleek, super sexy digital checkbook/expense tracker/bill reminder.Feel good knowing that you aren't giving away all of your personal information in exchange for a "free" app. So called "free" applications collect yo... Lihat lebih banyak

Easily track your finances, all in one place in this smart, sleek, super sexy digital checkbook/expense tracker/bill reminder.

Feel good knowing that you aren't giving away all of your personal information in exchange for a "free" app. So called "free" applications collect your information and share it with advertisers. With Moola your information stays local to the app, and is not shared with advertisers. No websites to sign up with, no bothersome emails.

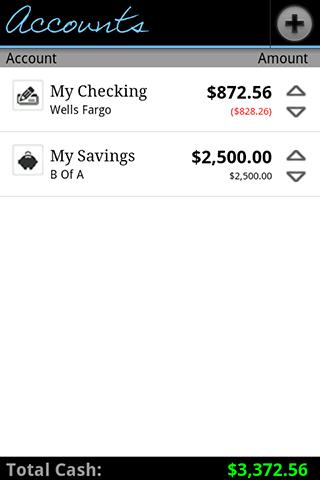

Without connecting to your bank, and for less than the price of lunch Moola can help you organize and track your money and bills all year long. See your banks, credit cards, and bills in one simple, streamlined application. Control where your money goes and get important real-time alerts and reminders about your accounts and bills. Moola is safe and secure, and unlike other financial apps, does not require sensitive banking information.

Key features:

• Track all your money and bills in one place

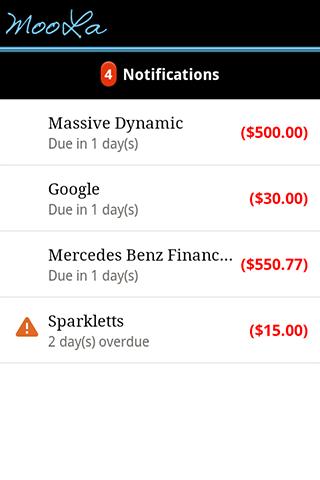

• Receive bill due date reminders with phone notifications (not emails)

• Password lock the app

• Get important account notifications (bill due dates)

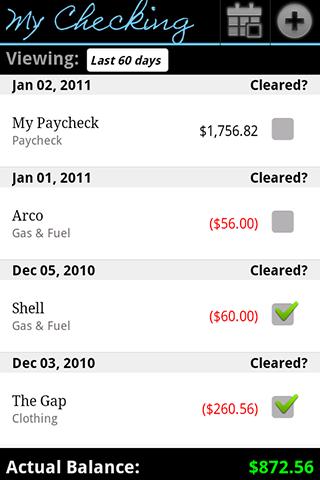

• View detailed bill & account statements

• Add an unlimited number of accounts

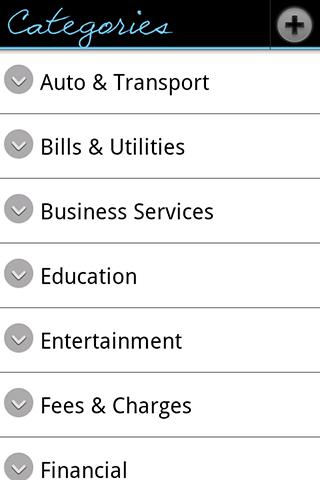

• Customizable categories

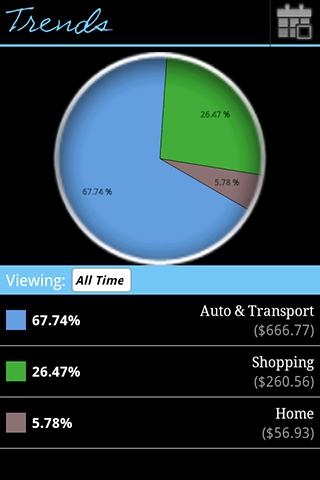

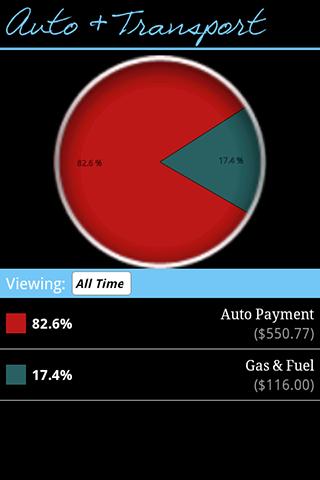

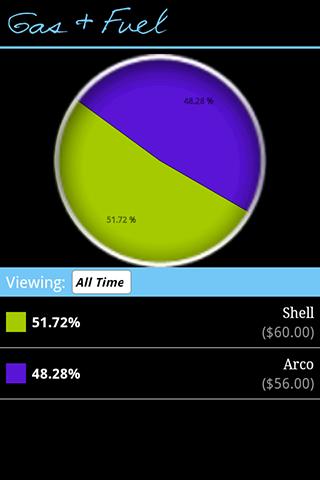

• View spending habits by category, subcategory, and payee

• Data import/export/backup

• Enjoy well deserved financial peace of mind

Extra (Paid) Features:

• Budgets

GET OUT OF DEBT!

This app helps you keep track of your money and bills, giving you a simple overview of your cash, bills, and credit card debt. Once you understand what you owe, you can find ways to budget your money better. Control your spending and bills due with transaction history, and never miss a bill with push notifications.

STOP OVERDRAFTING

Stop giving away your hard earned money to your bank! Banks hold your real account balance hostage in the hopes of charging you outrageous overdraft fees because you failed to manage your money properly.

Apps that download information from your bank, as it will not have accurate real-time information about your accounts. Credit/debit card purchases could take days to post to your accounts, and if you live on a tight budget you run great risk of overdrafting and paying ridiculous overdraft fees to your bank.